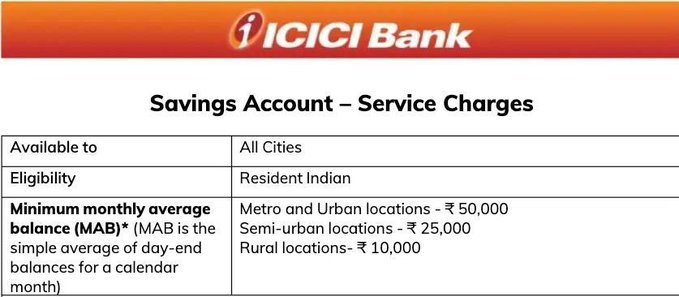

🏦 ICICI Bank Raises Minimum Balance to ₹50,000: What Every Account Holder Needs to Know

Starting August 1, 2025, ICICI Bank has made a bold move that could impact millions of Indians—especially those opening new savings accounts. The bank has hiked its minimum monthly average balance (MAB) requirement to ₹50,000 in metro and urban branches, making it the highest among all major banks in India.

So what does this mean for you? Whether you’re a salaried professional, a small business owner, or someone just trying to save for the future, here’s a breakdown of how this change could affect your wallet—and your banking habits.

New Minimum Balance Rules: A Big Leap

ICICI Bank’s new savings account rules are not just a minor tweak—they’re a game-changer.

| Branch Type | Old MAB (₹) | New MAB (₹) |

|---|---|---|

| Metro/Urban | 10,000 | 50,000 |

| Semi-Urban | 5,000 | 25,000 |

| Rural | 2,500 | 10,000 |

This means if you’re opening a new account in a city like Hyderabad, Mumbai, or Delhi, you’ll now need to maintain ₹50,000 every month—or pay a penalty.

Penalty Charges: What Happens If You Fall Short?

If your account balance dips below the required MAB, ICICI Bank will charge you 6% of the shortfall or ₹500—whichever is lower. For example:

- If you miss the ₹50,000 mark by ₹10,000, the penalty would be ₹600.

- But since the cap is ₹500, that’s the maximum you’ll pay.

It’s still a hefty fee for many middle-class customers, especially those used to lower balance requirements.

Cash Transaction Limits Tightened

ICICI Bank is also changing how you deposit cash:

- Only 3 free cash deposit transactions per month, up to ₹1 lakh total.

- Beyond that, you’ll pay ₹150 per transaction or ₹3.50 per ₹1,000—whichever is higher.

- Third-party cash deposits are capped at ₹25,000 per transaction.

This could be a big deal for small traders, freelancers, and families who rely on regular cash deposits.

Cheque Return Fees Increased

If a cheque bounces, here’s what you’ll pay:

- ₹200 for outward returns (cheques you deposit).

- ₹500 for inward returns (cheques you issue).

It’s a reminder to keep your account funded and avoid unnecessary penalties.

How ICICI Compares to Other Banks

ICICI Bank’s new rules set it apart from competitors:

| Bank Name | Metro MAB (₹) | Rural MAB (₹) |

|---|---|---|

| ICICI Bank | 50,000 | 10,000 |

| HDFC Bank | 10,000 | 2,500 |

| SBI | No minimum | No minimum |

SBI scrapped its minimum balance rule back in 2020, and most banks still keep their MAB between ₹2,000 and ₹10,000. ICICI’s move signals a shift toward premium banking—targeting affluent customers who are likely to invest in mutual funds, insurance, and wealth management services.

Who’s Affected and What You Can Do

- If you’re an existing ICICI customer, you’re safe for now—these rules apply only to new accounts.

- If you’re planning to open a new account, consider whether you can consistently maintain the new balance.

- Explore alternatives like SBI or Basic Savings Bank Deposit Accounts (BSBDAs), which have no minimum balance but limited features.

Why Is ICICI Doing This?

This change comes just months after ICICI Bank reduced its savings account interest rates:

- Up to ₹50 lakh: 2.75% interest

- Above ₹50 lakh: 3.25% interest

With falling interest rates and rising competition from fintechs, mutual funds, and private wealth firms, ICICI is clearly repositioning itself for high-value customers.

Final Thoughts: Is This the Future of Indian Banking?

ICICI Bank’s move may be the first domino. As India’s economy grows and wealth becomes more concentrated, banks are shifting focus from mass banking to premium services. But for everyday savers, this could mean fewer options and higher costs.

If you’re worried about maintaining ₹50,000 every month, it’s time to reassess your banking strategy. Look for banks that match your financial lifestyle—not just your location.

DO YOU NEED SBI CASH BACK CREDIT CARD : CLICK HERE AND APPLY NOW

Read also : 🌸 “The Thread That Never Breaks” – A Raksha Bandhan Story

Read also : India Stands Tall: From Shastri to Modi, a Legacy of Defiance Against U.S. Pressure

Read also : 🚶♂️ Walk at Least 7,000 Steps Daily!