Mukesh Ambani’s Reliance adds ₹28,282 crore in five days, Sensex hits record high

Reliance steals the spotlight

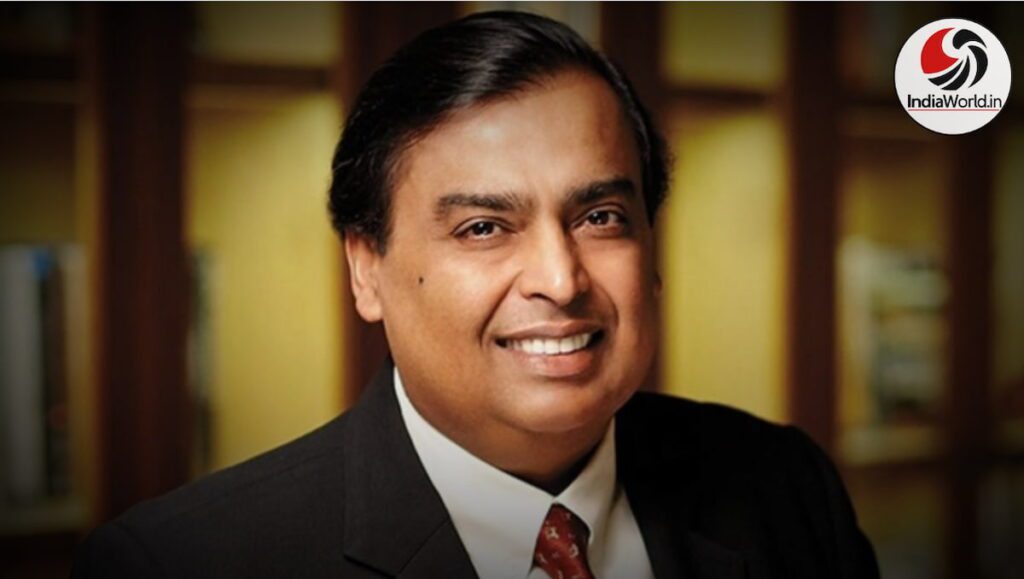

Mukesh Ambani, India’s richest man, has once again proven why Reliance Industries remains the crown jewel of Dalal Street. In just five trading sessions, Reliance added a staggering ₹28,282.86 crore to its market capitalization, cementing its position as India’s most valued company.

Mukesh Ambani Reliance market valuation, and it’s no surprise that this surge has become the talk of investors, analysts, and everyday traders.

Sensex touches new heights

The broader market reflected this optimism. The BSE Sensex climbed 474.75 points (0.55%), hitting a record high of 86,055.86. This rally wasn’t just about Reliance—it was a collective push by India’s top companies. Seven of the ten most valued firms added a combined ₹96,200.95 crore to their valuations last week.

Who gained the most?

Reliance led the charge, but other giants also rode the wave:

- Bajaj Finance: Up ₹20,347.52 crore, now valued at ₹6,45,676.11 crore.

- HDFC Bank: Surged ₹13,611.11 crore, reaching ₹15,48,743.67 crore.

- ICICI Bank: Added ₹13,599.62 crore, now at ₹9,92,725.97 crore.

- Hindustan Unilever: Gained ₹7,671.41 crore, touching ₹5,79,644.16 crore.

- State Bank of India (SBI): Rose ₹6,415.28 crore, valued at ₹9,04,185.15 crore.

- Infosys: Narayana Murthy’s tech giant climbed ₹6,273.15 crore, now at ₹6,47,961.98 crore.

This collective momentum shows how India’s banking and consumer sectors are thriving alongside Reliance’s energy-to-digital empire.

Who stumbled?

Not everyone shared the joy. Three heavyweights slipped:

- Bharti Airtel: Lost ₹35,239.01 crore, down to ₹11,98,040.84 crore.

- TCS (Tata Consultancy Services): Dropped ₹3,762.81 crore, now at ₹11,35,952.85 crore.

- LIC (Life Insurance Corporation of India): Declined ₹4,996.75 crore, valued at ₹5,65,581.29 crore.

These declines highlight the volatility in telecom, IT, and insurance sectors, even as banks and energy firms soared.

Reliance remains king

Despite competition, Reliance continues to dominate. Its market cap now stands at ₹21,20,335.47 crore, keeping Ambani firmly ahead of rivals. The company’s diversified portfolio—oil-to-chemicals, telecom (Jio), retail, and green energy—makes it resilient to sector-specific shocks.

Why this matters for investors

Reliance’s surge isn’t just about numbers. It signals:

- Investor confidence in Ambani’s long-term vision.

- Strength in diversified sectors, from energy to digital.

- Momentum in Indian equities, with global investors eyeing opportunities.

For retail investors, this rally is a reminder that Reliance remains a safe bet in uncertain times.

Trending queries answered

- Why did Reliance gain ₹28,282 crore?

Strong performance in energy and telecom, coupled with investor optimism. - Is Reliance still India’s most valued firm?

Yes, it leads ahead of HDFC Bank and Bharti Airtel. - Which sectors are driving growth?

Banking, finance, consumer goods, and energy. - Who lost value last week?

Airtel, TCS, and LIC.

Evergreen context

Reliance’s story is more than weekly numbers. Ambani’s strategy of balancing traditional energy with futuristic digital and green ventures keeps the company relevant. As India pushes toward renewable energy and digital transformation, Reliance is positioned to lead both.

Emotional hook

For millions of Indian investors, Ambani’s success feels personal. Reliance isn’t just a company—it’s a symbol of India’s economic rise. Every surge in its valuation echoes confidence in India’s growth story.

Read also || Elon Musk Hails Indian Talent as America’s Hidden Powerhouse

CTA Links

- More updates follow us: https://x.com/vishnu73

- Join our Arattai Group: aratt.ai/@indiaworld_in

- 👉 Telegram Channel: t.me/indiaworld_in

- 📰 Visit IndiaWorld.in for:

External Links

- Reliance Industries – Wikipedia

- Bombay Stock Exchange – Official Site

- SEBI – Securities and Exchange Board of India

- Infosys – Wikipedia

- Bharti Airtel – Wikipedia