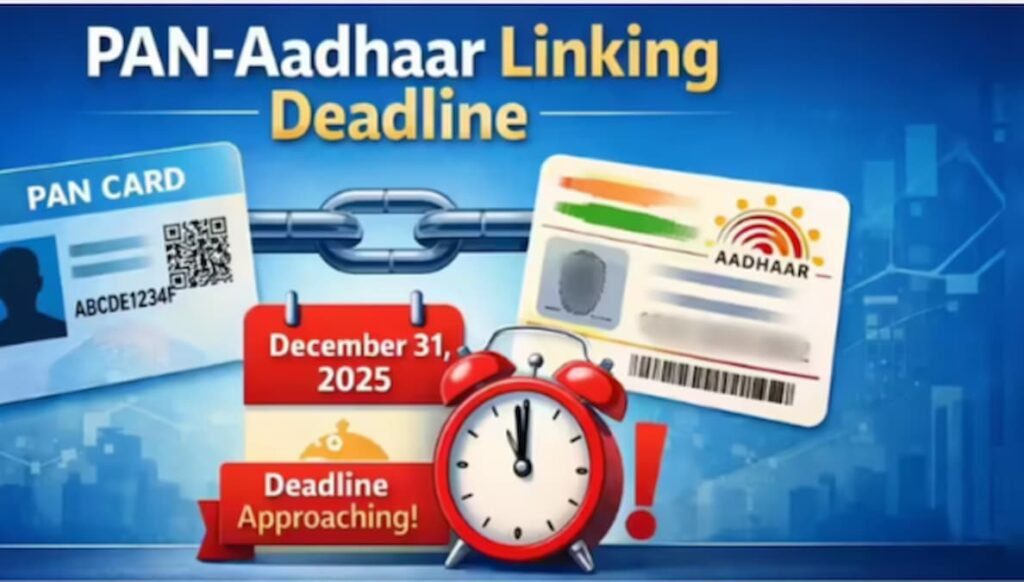

PAN-Aadhaar Link Deadline: What Happens If You Miss December 31, 2025

Why PAN-Aadhaar Linking Matters

The PAN-Aadhaar link deadline is December 31, 2025. If you don’t complete the process, your PAN card will become inoperative from January 1, 2026. That means you won’t be able to file income tax returns, claim refunds, or carry out financial transactions where PAN is mandatory.

The Income Tax Department has repeatedly urged taxpayers to finish linking before the cutoff date. Missing it can cause serious disruptions in everyday financial life.

What Happens If PAN Becomes Inoperative

An inoperative PAN is more than just a technical issue. It directly impacts your financial freedom:

- You cannot file income tax returns.

- Refunds will not be processed.

- Higher TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) rates will apply.

- You cannot open new bank accounts or invest in securities where PAN is required.

- Routine transactions like property deals, stock trading, or even applying for loans may be blocked.

Penalty & Exemptions

- Penalty: ₹1,000 late fee applies if you link PAN after the deadline.

- Exemption: PAN cards issued after October 1, 2024 using Aadhaar enrolment ID are exempt from the late fee.

- Mandatory: For PAN allotted on or before July 1, 2017, linking with Aadhaar is compulsory.

How to Link PAN with Aadhaar (Step-by-Step)

- Log in to the Income Tax e-filing portal.

- Go to Profile → Link Aadhaar.

- Enter PAN and Aadhaar details.

- Proceed with payment via e-pay tax (₹1,000 if applicable).

- Select Other Receipts as payment category.

- Generate challan and pay via your bank portal.

- Return to the portal, validate PAN and Aadhaar details.

- Enter OTP sent to Aadhaar-linked mobile number.

- Submit request.

Verification usually completes within 1–2 days once UIDAI validates the details.

How to Check PAN-Aadhaar Link Status

- Online:

- Visit the e-filing portal.

- Click Check Aadhaar Link Status.

- Enter PAN and Aadhaar details.

- SMS:

- Type:

UIDPAN <12-digit Aadhaar> <10-digit PAN> - Send to 567678 or 56161.

- Example:

UIDPAN 34512349891 CFIED1234J

- Type:

What If PAN & Aadhaar Don’t Match?

Discrepancies are common. Here’s how to fix them:

- Update Aadhaar details via UIDAI portal.

- Update PAN details via Protean (NSDL) or UTIITSL.

- If issues persist, visit an authorised PAN service centre for biometric verification.

FAQs on PAN-Aadhaar Linking

Q: What if I miss the deadline?

👉 Your PAN becomes inoperative from Jan 1, 2026.

Q: Can I still link after the deadline?

👉 Yes, but you must pay ₹1,000 penalty first.

Q: Who is exempt?

👉 PAN issued after Oct 1, 2024 using Aadhaar enrolment ID.

Q: What does “inoperative PAN” mean?

👉 You cannot use it for tax filing, refunds, or financial transactions.

Why Government Made It Mandatory

The government’s push for PAN-Aadhaar linking is aimed at:

- Eliminating duplicate PANs.

- Preventing tax evasion.

- Ensuring accurate identity verification.

- Streamlining financial compliance.

Experts say this move strengthens India’s digital tax ecosystem and reduces fraud.

Trending Queries

- “PAN Aadhaar link deadline 2025”

- “How to check PAN Aadhaar status online”

- “Penalty for not linking PAN Aadhaar”

- “What happens if PAN becomes inoperative”

- “UIDAI PAN Aadhaar linking process”

Final Word

With the December 31, 2025 deadline just hours away, taxpayers must act fast. Linking PAN with Aadhaar is not just a compliance step—it’s essential for smooth financial life in 2026.

CTA Links

- More updates: X.com/vishnu73

- Join Arattai Group: aratt.ai/@indiaworld_in

- 👉 Telegram Channel: t.me/indiaworld_in

- 📰 Visit IndiaWorld.in

External References: