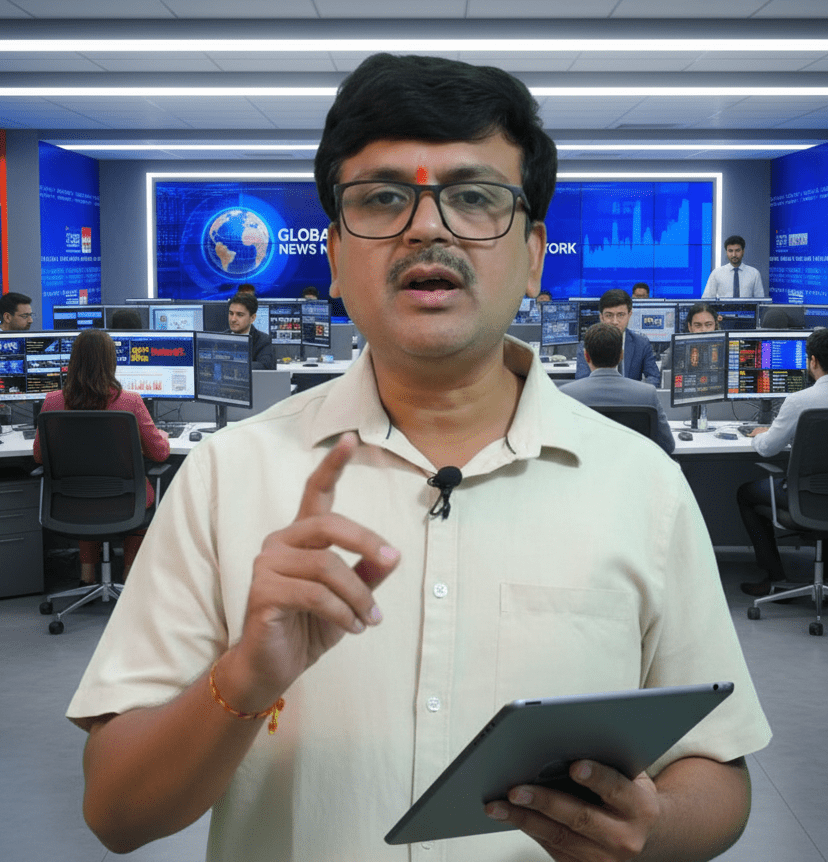

What Warren Buffett Wants India’s EMI Generation to Understand About Debt and Financial Freedom

Warren Buffett’s warning to India’s EMI generation highlights the hidden dangers of easy credit, rising debt, and the psychological trap of “no-cost EMIs.” His timeless advice urges young Indians to live within their means, prioritize savings, and avoid the mental burden of compounding debt.

Introduction: The Festival of Debt?

It’s that time of year again—Diwali lights are glowing, new iPhones are launching, and “no-cost EMI” offers are flooding your screen. From flagship smartphones to designer clothes, everything seems just a swipe away. But behind the sparkle lies a growing concern: India’s EMI generation is sinking deeper into debt, often without realizing it.

Warren Buffett, one of the world’s most respected investors, has long warned against the seductive nature of easy credit. His advice is especially relevant today, as young Indians increasingly rely on EMIs and credit cards to fund their lifestyles. Let’s unpack his wisdom and explore how it applies to our modern spending habits.

The Rise of EMI Culture in India

- Nearly 70% of iPhone buyers in India opt for EMI plans

- 93% of salaried individuals earning under ₹50,000/month use credit cards for daily expenses

- EMIs are no longer reserved for homes or cars—they now cover phones, vacations, and even clothing

Retailers are offering 24-month EMI plans with cashback deals, making it feel “logical” to split payments. But when multiple EMIs stack up and credit card interest hits 36–40% annually, the financial strain becomes real.

Why “No-Cost EMI” Isn’t Really Free

The psychology behind EMIs is clever. Instead of paying ₹80,000 upfront for a phone, you’re asked for just ₹6,000 a month. It feels painless—until you realize:

- Credit card balances can double in two years if left unpaid

- Buy Now Pay Later (BNPL) schemes have a 25% default rate

- EMIs quietly consume a third of your monthly income

Add a job loss or emergency, and the house of cards collapses. Buffett’s advice? Don’t let debt steal your future.

Warren Buffett’s Timeless Rules for Financial Health

1. Save First, Spend Later

Buffett believes in paying yourself first. Decide how much to save before spending anything. Even small amounts matter—habits build wealth.

2. Credit Is a Convenience, Not Extra Money

A credit card isn’t free cash. If you’re not paying off the full bill monthly, you’re already in trouble. In India, card interest can reach 40% annually—that’s not a loan, it’s a trap.

3. Let Compounding Work for You

Buffett loves compounding—but only when it builds wealth. EMIs and unpaid bills also compound, but they shrink your freedom instead of growing it.

4. Build an Emergency Cushion

Life is unpredictable. A small savings buffer can prevent you from taking on debt during tough times. Buffett’s advice isn’t anti-enjoyment—it’s pro-preparedness.

The Hidden Cost of Keeping Up Appearances

Social pressure plays a huge role. During festive seasons, when everyone’s upgrading, it feels irresponsible not to join in. But:

- Debt leads to mental stress

- EMIs reduce financial flexibility

- Credit dependence limits your ability to invest or save

Buffett’s wisdom reminds us: “You cannot get rich by spending more than you earn.”

What India’s EMI Generation Can Learn from Buffett

- Live within your means: Don’t confuse wants with needs

- Avoid lifestyle inflation: Just because you earn more doesn’t mean you should spend more

- Focus on long-term goals: Financial freedom > instant gratification

- Track your expenses: Awareness is the first step to control

A Personal Plea This Festive Season

As gadgets flood store shelves and EMI offers tempt you, pause and reflect. The phone will age, the clothes will fade—but debt lingers. Buffett’s voice is a quiet reminder: true celebration lies in freedom, not in borrowed joy.

So enjoy the season, but don’t build your happiness on borrowed money. The real festival is living debt-free.

Choose Freedom Over Flash

Warren Buffett didn’t become one of the richest people by chasing shiny objects. He built wealth through discipline, patience, and a deep respect for financial freedom. His advice to India’s EMI generation is simple but powerful: avoid debt, save consistently, and let compounding work in your favor.

This festive season, choose freedom over flash. Your future self will thank you.